- A quant fund with a predominantly French leadership team that hires a lot from banks and is doing incredibly well. We could of course be talking about Squarepoint but in this article we will be analysing Qube Research and Technologies ("Qube" for rest of this article because we are not trying to hit 5,000 words so strap in because this is not the first abbreviation); the prop group spin out from Credit Suisse that doubled profits last year.

Skip to:

History

The genesis of Qube began with the Global Arbitrage Trading (GAT) group at Credit Suisse which was then led by Bobbi Jain (now CIO at Millennium). Following the 2008 crises the prop group trimmed the discretionary PMs and became SMG (Systematic Markets Group) with two competing desks. One led by Pierre-Yves Morlat, otherwise known as Pym, based in Paris and the other by Nick Branca in New York. In 2016, Credit Suisse moved SMG out of the bank and into their asset management arm to avoid the Volcker rule. This arrangement did not last long however, and the two teams span out officially from CSAM in 2018. Pym's team forming Qube and Nick Brancas team forming QT Fund. Unfortunately, QT closed its doors in 2020.

According to their ADV filings, Qube had positions with a Gross Market Value around $1 billion back in 2018. This now stands at $9 billion GMV through four private funds; Qube Fund, Torus Fund, Prism Fund and QSMA Torus Fund.

Leadership

Pierre-Yves Morlat Chief Executive Officer:

A well-trodden path in France, Pierre-Yves graduated from CentraleSupélec and began his career at SocGen as an Equity Derivatives Proprietary Trader. He worked his way up to Global Head of Arbitrage, before joining Credit Suisse in 2009 as the Head of Proprietary Arbitrage Trading for Europe and Asia.

Laurent Laizet Chief Investment Officer

A Maths and Econ graduate of Ecole Polytechnique, Laurent began his career as a quant at Soc Gen, before moving to Credit Suisse in 2009 as Head of SMG Europe. Hmm sounds familiar.

Nick Harris Chief Technology Officer

A graduate in Engineering from Durham University, Nick joined the SMG team in 2016 (so a relative newby). Prior to teaming up with Pym and Laurent he held senior roles at UBS, Liquid Capital and Merrill Lynch.

Taro Hornmark Head of Asia

Another SMG veteran, Taro bounced between HK and NY for the past decade however appears to have settled now as the Head of Asia for Qube in HK.

Stuart David Brown Chief Operating Officer

Stuart joined Credit Suisse in 2005 within middle office, progressing to become European COO for the SMG team in 2011.

Corporate Structure & Profits

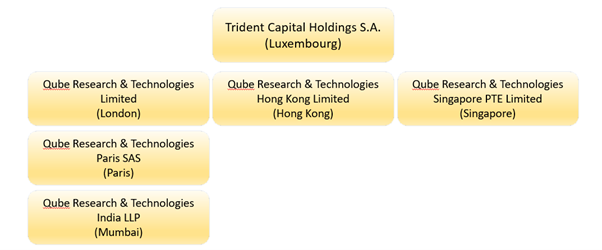

Based on our own rudimentary analysis, the corporate structure is as follows. Trident Capital Holdings is the holding company based in Luxembourg with three companies underneath representing HK, Singapore with London incorporating Paris and India.

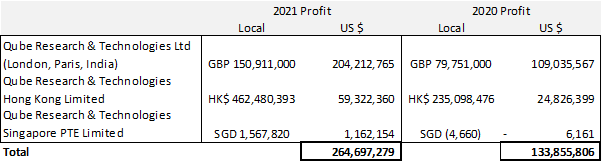

The annual reports show profit doubled in 2021. The “profit” is a combination of management and performance fees so with a crude estimate (based on 2 and 20 fee structure) would suggest trading PNL in the region of $1bn for 2021.

The regional profits for (converted in US$ at year end) were as follows:

Locations & Growth

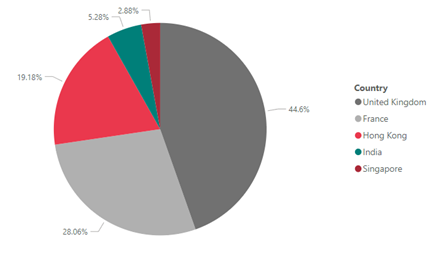

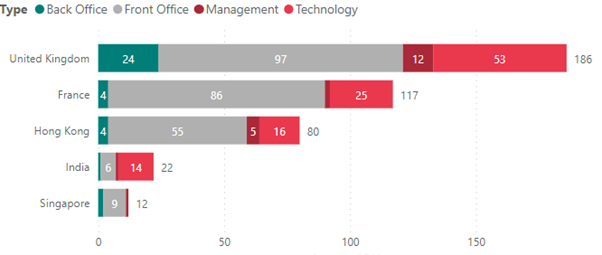

Acording to our research, Qube currently employs around 417 people. Surprisingly, Qube had no US presence… yet. Purely speculation but perhaps territories were ring fenced when Qube and QT fund split in 2018. They could also believe they can do everything from Europe, which they are at present, however it does seem strange that they would not want to tap into the significantly larger US talent pool.

Qube has continued to grow its European presence, with a significant increase in new headcount 2021, in contrast to Asia’s static growth year on year.

Functional split

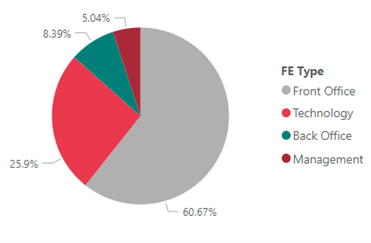

Most funds have roughly 1/3 of headcount in investments, 1/3 in technology and 1/3 in back office however Qube is strikingly front office heavy. There may be some blur between research and technology as the strategies are mostly fully systematic so researchers can build their own tools and implement strategies. Back-office functions are very light – can only assume they have very good automation.

Most of the offices are dominated by front office folks with the exception of India which is 2/3 technology and London which houses most of the back office and additional technology headcount.

Academic Backgrounds

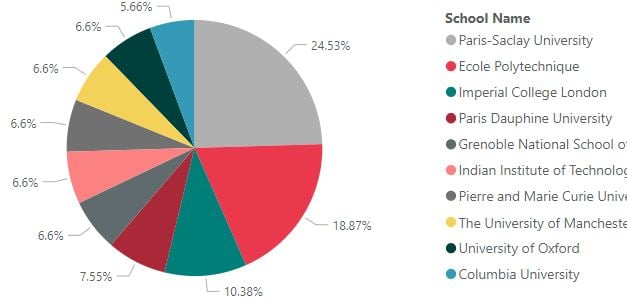

Qube hires from top universities in France, United Kingdom, India, and the US. Across all departments, about 25% employees hail from one of France’s best universities, University of Paris-Saclay. The chart below depicts the Top 10 universities attended by Qube’s employees.

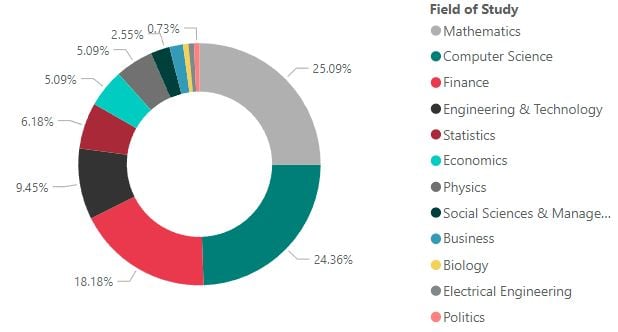

As you would expect from a quant fund STEM subjects make up the bulk of subjects studied.

Conclusion

The leadership of many of todays successful quant hedge funds started their careers on bank prop desks. See Bank Prop desks - where are they now ? It was a fertile training ground that provided a relatively quick path to managing a book and trading your own strategies. It's a shame that avenue is gone for aspiring quants and traders. Prop trading firms have picked up the slack and to some extent, quant hedge funds (although the path to managing your own book is considerably longer).

It might just be a bit more tricky for the Pyms and Laurents of tomorrow - unless you're in crypto - dependent on which day you read this that could be a good or bad thing :)