China’s total Asset Management industry is about 13 trillion USD, of which Private Fund Managers (PFM), offering domestic securities products, make up 14%. Twenty-six Wholly Foreign-Owned Enterprises (WFOEs) have become PFMs since the market was opened to foreign companies, but they are behind the curve in terms of fundraising. According to Bloomberg, the assets raised by foreign firms are 36% below the mean of their Chinese competitors – all except Winton.

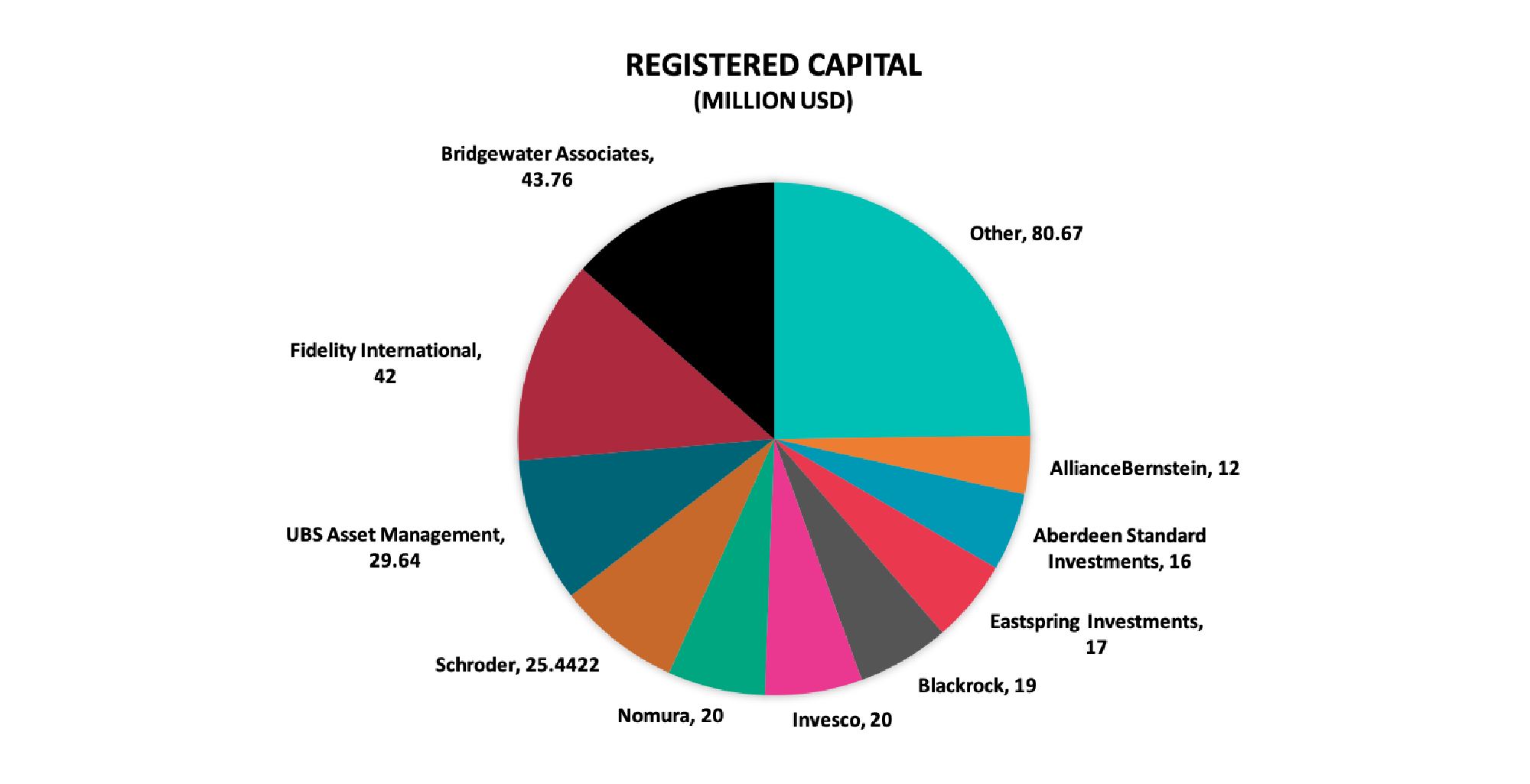

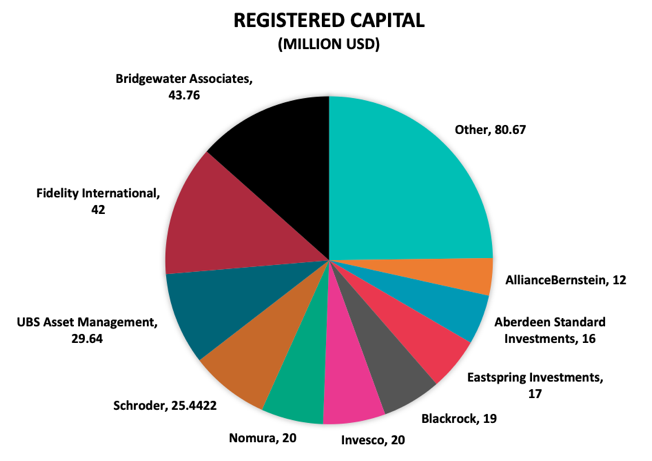

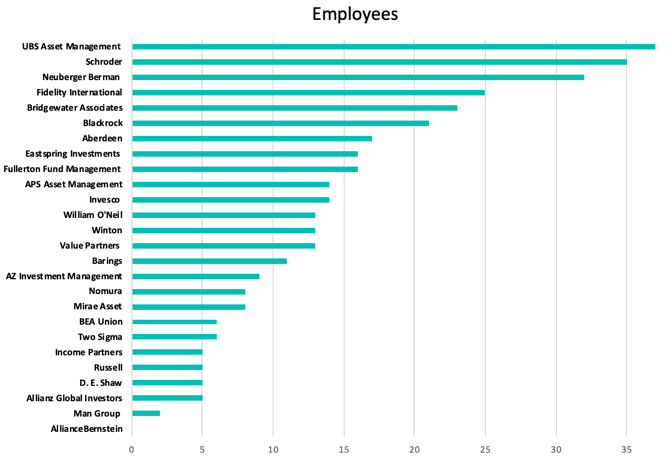

The average registered capital of the funds is about 12.5 million USD. The PFMs with the highest registered capital are Fidelity International and Bridgewater with 42 million USD and 43.76 million USD. The number of investment staff correlates with how long the firms have been established indicating a cautious path to growth. William O’Neill bucked this trend however hiring 13 investment staff in their first year.

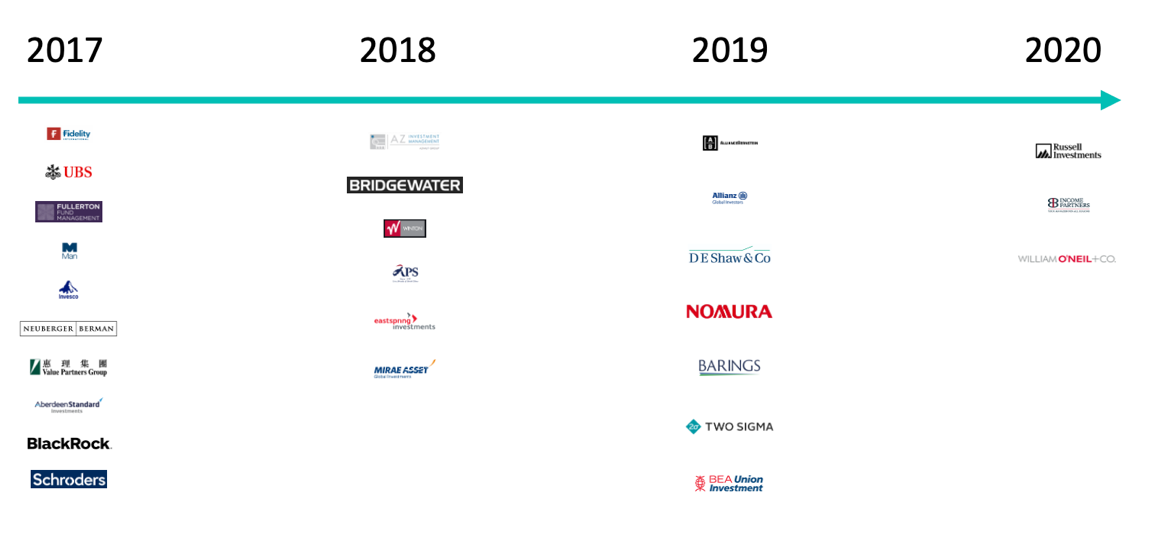

WFOEs have not been daunted, however, and have continued to apply for PFM licences. Seven WFOEs were licensed as Private Fund Managers by the Asset Management Association of China in 2019, and three WFOEs have been licensed so far this year including Russell Investments, Income Partners, and William O’Neil. All of the foreign funds have decided to set up shop in Shanghai with the lone exception of BEA Union Investment which set up its Chinese headquarters in Shenzhen.

Timeline

Source: Asset Management Association of China (Amac)

Understanding Chinese licenses

Funds in China can have two different licences, a PFM licence, which lets a firm offer domestic products to domestic investors, and a Qualified Domestic Limited Partnership (QDLP) licence, which permits a firm to offer foreign products to domestic investors. These licences are granted by the Asset Management Association of China (Amac).

A fund first registers as an Investment Management Wholly Foreign-Owned Enterprise (IM WFOE) with State Administration for Market Regulation (SAMR) then obtains a PFM or QDLP licence (or both) from Amac. Some WFOEs have opted to obtain both licences, including UBS, Blackrock, Aberdeen Standard, and Neuberger Berman.