Note: The focus of this article is on proprietary trading firms in HFT rather than hedge funds. We did not include the HFT operations of hedge funds for the sake of brevity although we did make a couple of exceptions. We are including Citadel because we couldn’t write a HFT article without them. We also included TGS Management because they are a bit of an enigma and based on trading volumes needed to be included.

The other noticeable exceptions are the proprietary trading desks within banks who up until Volker were also major HFT players. This included BNP Paribas, Credit Suisse, Deutsche, Goldman Sachs, Lehman Brothers, Merrill Lynch, Morgan Stanley, Societe Generale and UBS to name a few.

High-Frequency trading has been around since people started speculating. In essence, the goal of a trader is to be an informed investor. That means having all the information required at the right time to make an informed decision about whether to trade or not. Technology has simply enabled traders to process, consume and respond to market information at ever-increasing speeds.

The pioneers of applying technology and more quantitative approaches to trading lie in the trading pits of Chicago and Amsterdam. Firms like Getco, Hull, Citadel, Jump Trading and IMC began a revolution in trading that has significantly reduced trading spreads but also generated an equal amount of controversy. More akin to technology firms these HFT firms did need to be based in the banking hubs.

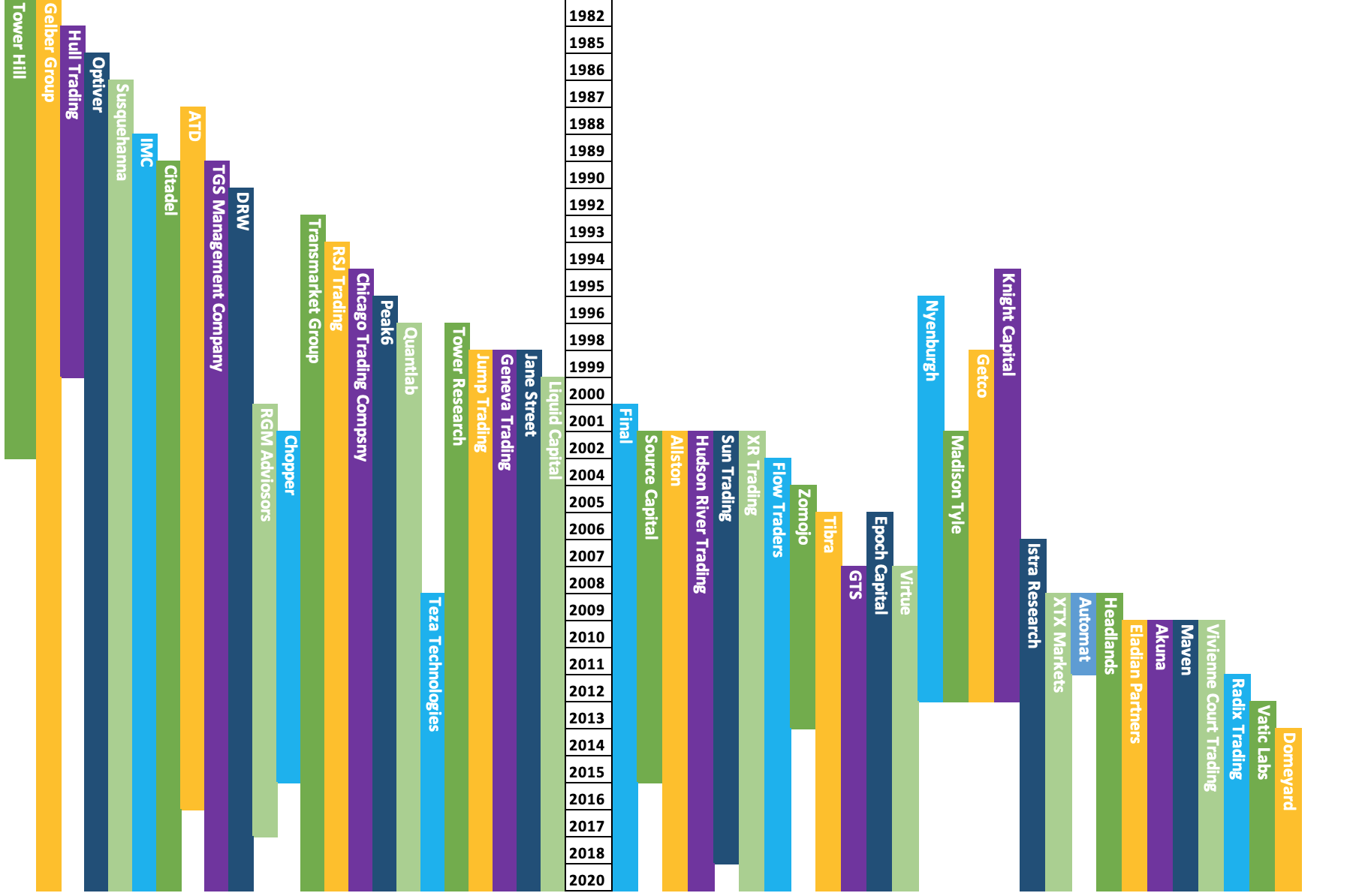

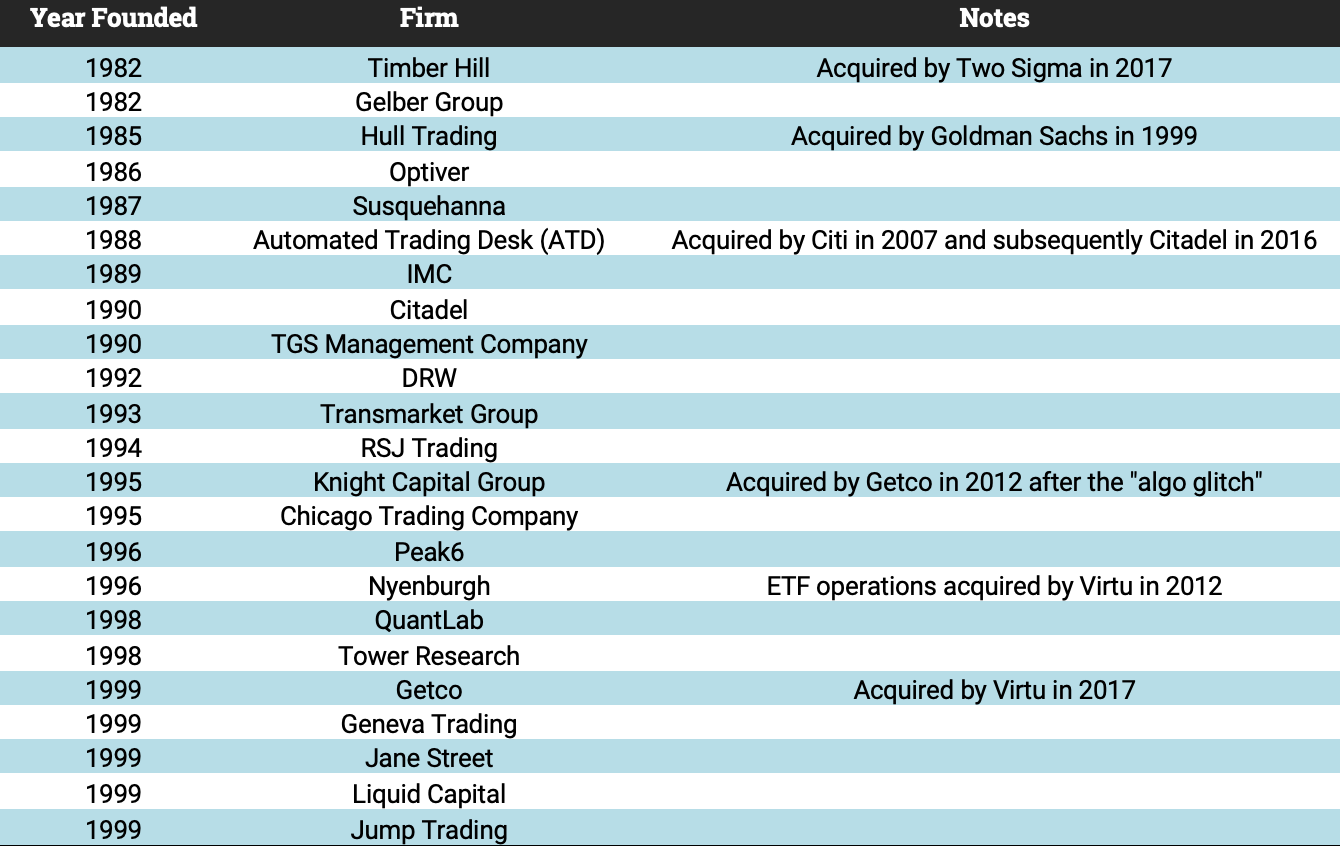

The pioneers of HFT

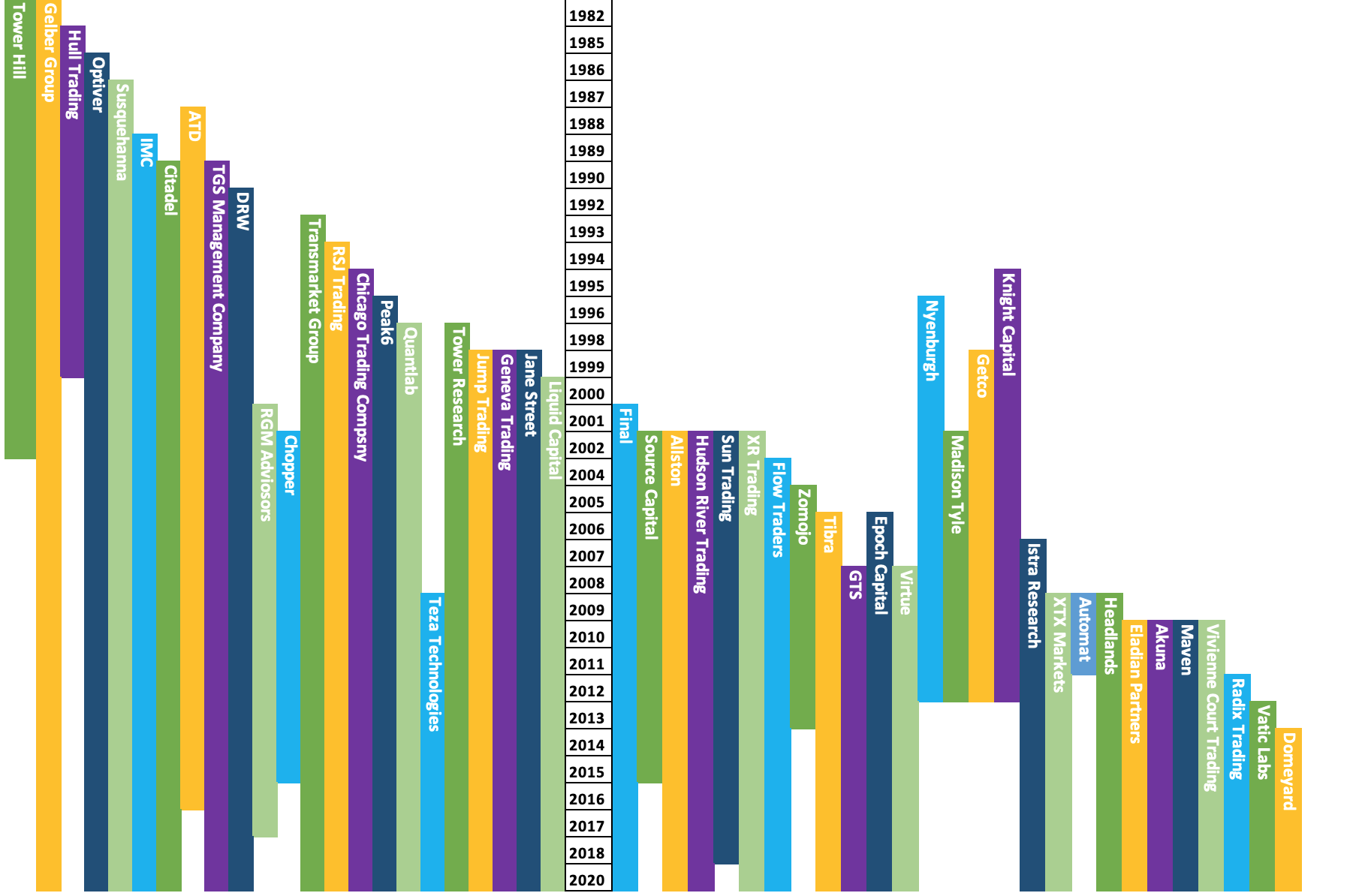

Out of the 22 HFT firms that started pre-2000, 16 are still going strong. Other than Knight Capital who famously lost $460ml due to a rogue trading algorithm, acquisitions from this group have been strategic and premiums have been paid by the acquirer.

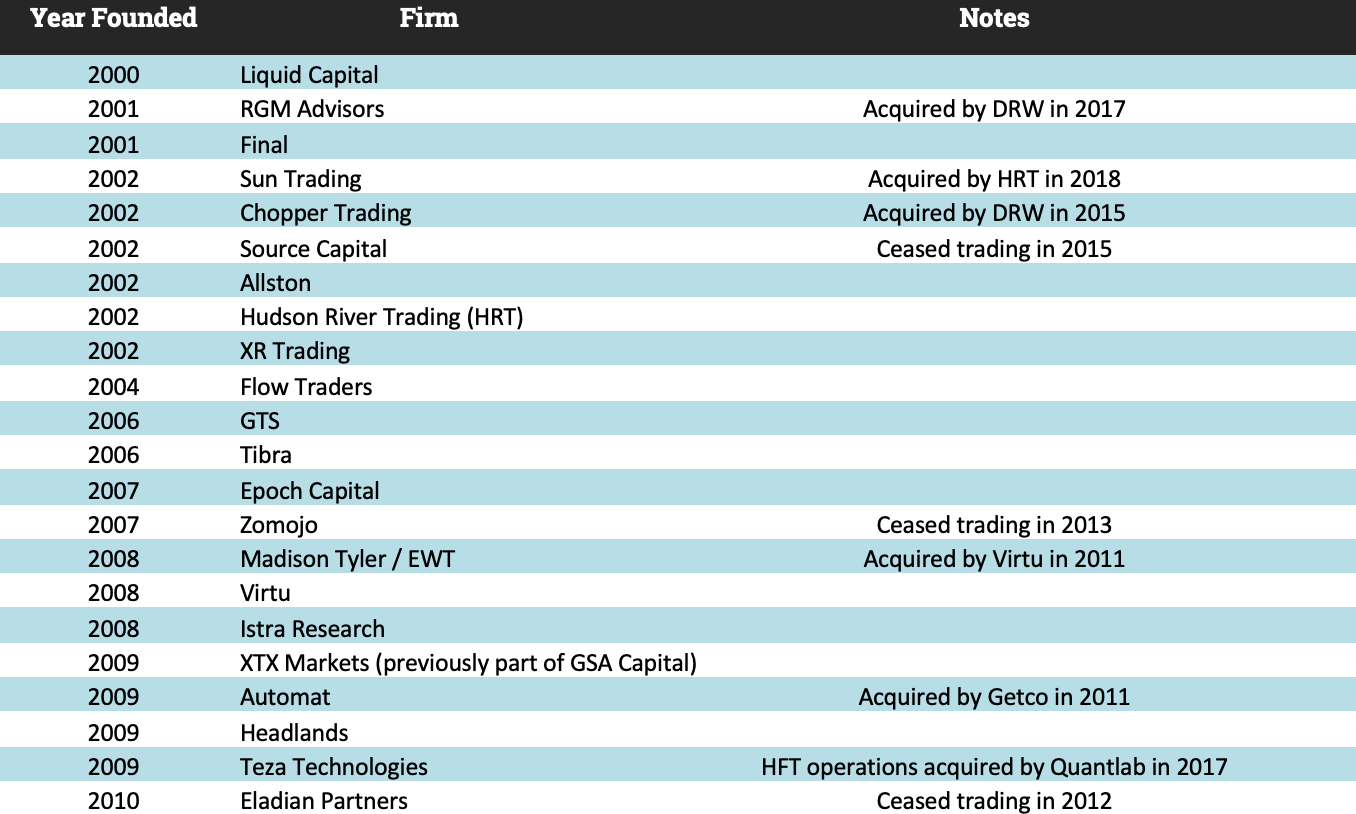

The new wave

The next decade of HFT start-ups had a tougher time. Only 13 remains of the 21 firms that started between 2000 and 2010. Firms like Eladian Partners and Automat burst onto the scene towards the end of the decade however spiralling costs associated with HFT and increased competition meant a quick demise. This trend continued and was exasperated by the low vol and trading volumes from 2016 onwards and led to significant consolidation with Virtu, DRW, HRT and Quantlab swooping on struggling targets.

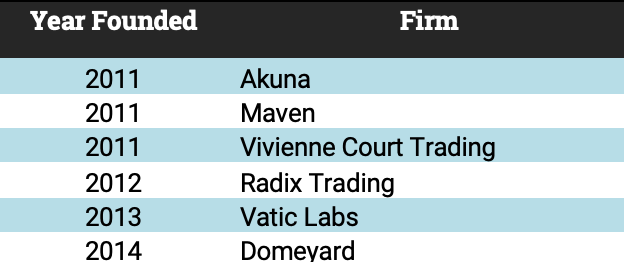

The next generation

With the exception of Domeyard, the firms that followed post-2010 have all been established by veterans of HFT. The experiences they picked up during the growth and lean years from their previous employers have served them well as they are all still here. The lack of new entrants (other than SandiaPoint and a few others) has been a reflection of the high technology start-up costs as well as the market environment.

The outlook

The spike in volatility and volumes in 2020 has given a significant boost to the HFT industry. Across the board, firms are recording record quarters and in general, the industry has avoided any major blows up or public scrutiny. As the HFT industry continues to gobble up trading revenues from banks across more asset classes, will we see the third generation of new HFT firms?

Listed companies:

1.Timber Hill, 2. Gelber Group, 3. Hull Trading, 4. Optiver, 5. Susquehanna, 6. IMC, 7. Citadel, 8. Automated Trading Desk, 9. TGS Management Company, 10. DRW, 11. RGM Advisors, 12. Chopper, 13. Transmarket Group, 14. RSJ Trading, 15. Chicago Trading Company, 16. Peak6, 17. Quantlab, 18. Teza Technologies, 19. Tower Research, 20. Jump Trading, 21. Geneva Trading, 22. Jane Street, 23. Liquid Capital, 24. Final, 25. Source Capital, 26. Allston, 27. Hudson River Trading, 28. Sun Trading, 29. XR Trading, 30. Flow Traders, 31. Zomojo, 32. Tibra, 33. GRT, 34. Epoch Capital, 35. Virtue, 36. Nyenburgh, 37. Madison Tyle, 38. Getco, 39. Knight Capital, 40. Istra Research, 41. XTX Markets, 42. Automat, 43. Headlands, 44. Eladian Partners, 45. Akuna, 46. Maven, 47. Vivienne Court Trading, 48. Radix Trading, 49. Vatic Labs, 50. Domeyard.