This is the semi-annual Grainstone Lee report analysing the recruitment patterns of firms that employ quantitative investment strategies. The report contains an in-depth analysis of the hiring and competitive landscape within key geographical regions.

The semi-annual report contains thousands of sourced data points across the largest financial job functions from Quantitative Investment & Trading to Business Development and Compliance.

Skip to:

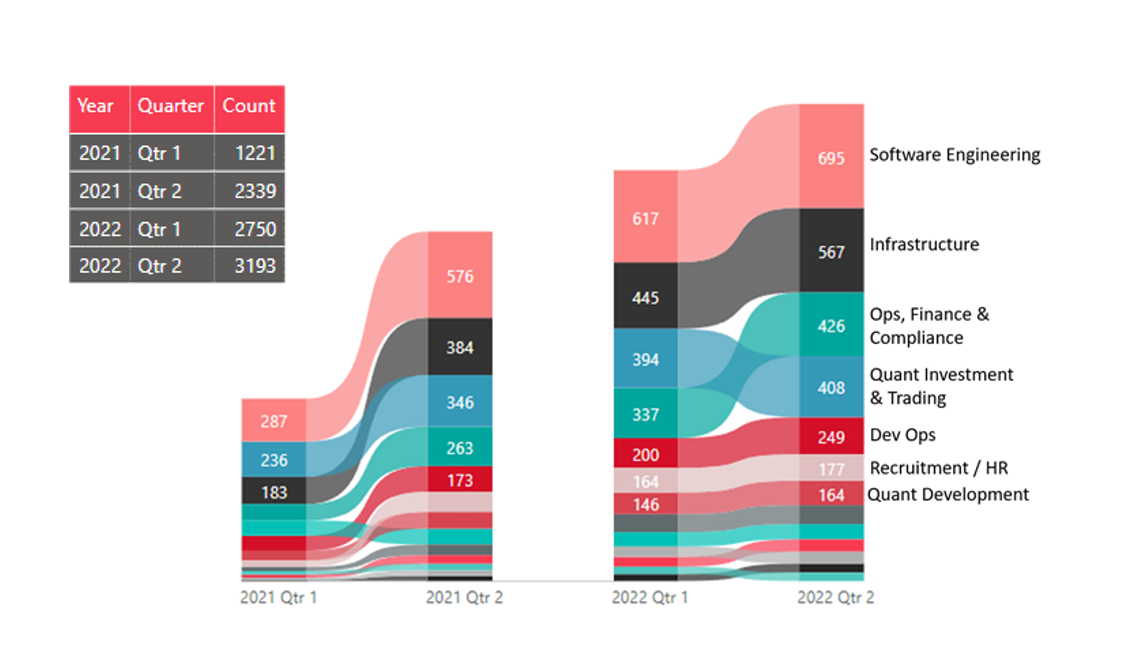

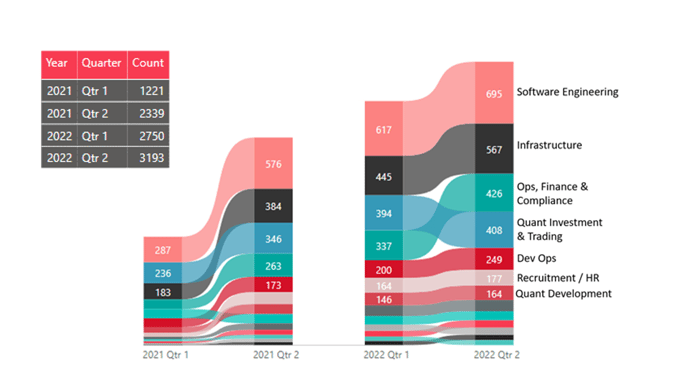

Open roles at the beginning and end of H1 2021 & 2022

Open roles H1 2021 & 2022

The total number of open roles at the beginning of January 2022 was 2,750 increasing to 3,193 by the end of June. This is significantly more than previously seen in H1 2021, with more open roles across every quarter. Software engineering remains in the lead with the highest count of open roles in both years. Most functions saw a massive spike in H1 21 in open roles as firms emerged from the pandemic. Growth has continued to trend upwards however at a slower pace.

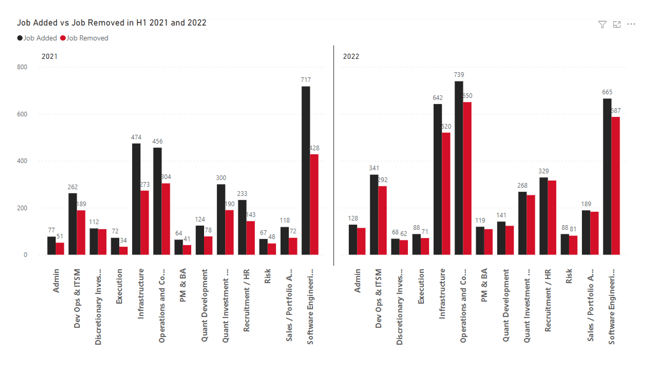

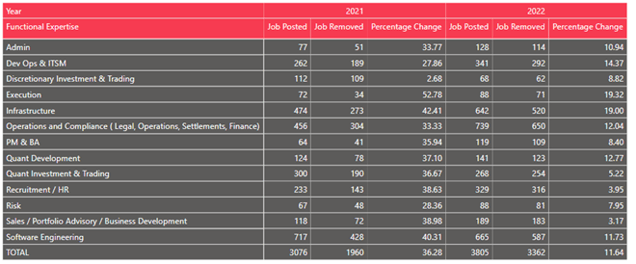

Job posting turnover

The below chart gives a breakdown of the number of jobs added vs the number of jobs removed per job function in H1 2021 and H1 2022. Notable growth in turnover is seen in Infrastructure and Operations & Compliance as compared to 2021 which would indicate healthy demand and supply to fill the open roles.

Overall, there is a majority increase in both jobs added and removed from H1 2021 to H1 2022 across the functional expertise indicating a more fluid recruitment market. Discretionary Investment & Trading, Quant Investment & Trading and Software Engineering actually saw less jobs added however this can be explained by firms using generic job postings for these functions.

If a job posting has been removed, it usually indicates a role has been filled or at least no longer available. There was a significant difference in 2021 between jobs posted (3,076) and removed (1,960) highlighting how illiquid the recruitment market was in 2021 (which also explains some of the wage inflation). The figures for 2022 show a more fluid distribution which hopefully indicates a healthier recruitment market.

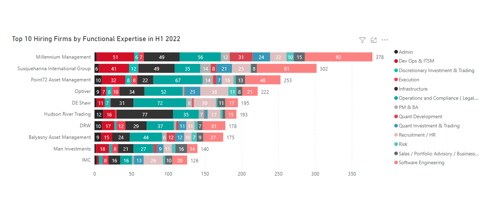

Top 10 hiring firms

The top 10 most active firms by number of job postings are:

The top hiring firm in H1 2022 is Millennium Management, with the most job postings for Software Engineering roles. Hudson River Trading is making a big push in infrastructure hiring with nearly 40% of their overall jobs posted.

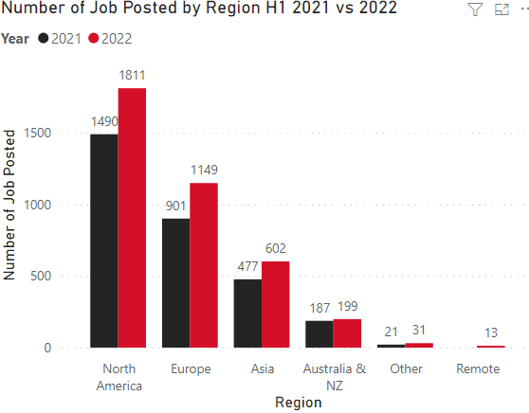

Where are firms hiring?

The bar chart below shows where most jobs have been posted in H1 2021 vs 2022.

The number of jobs posted across all regions increased in 2022. The highest number of jobs posted were within North America, however, Europe saw the highest % increase in jobs posted from 2021 to 2022 by 28%. Significantly, H1 2022 now includes job postings that are specifically remotely located which was not seen in H1 2021.

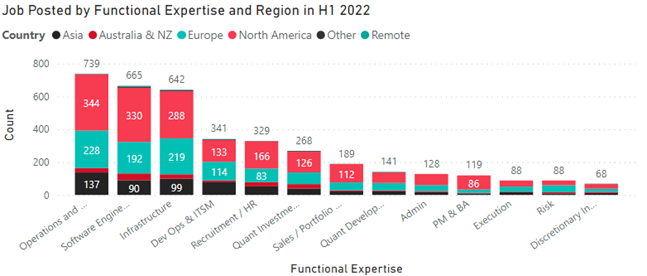

The table below shows a breakdown of job functions by region.

Operations and Compliance (Legal, Operations, Settlements, Finance) shows strong demand across all regions as well as Software Engineering and Infrastructure roles. Across all functions, North America has the most job postings. The only exception is Risk, with 42 job postings located in Europe.

Notes for the report

The figures were captured from the career sites of the below firms between 1st January – 30th June 2021 and 2022.

It’s worth noting that not every firm posts all of their open roles on their career sites so the actual activity and/or number of live roles may be different. This report only seeks to analyse the publicly available information.

We will also caveat that just because a role was removed does not necessarily mean that it has been filled although it’s reasonable to assume that if somebody has taken the time to upload or remove a role there is a reason behind it.

Firms analysed

3Red Partners

ABC Arbitrage

Acadian Asset Management

Akuna Capital

Allston Trading

AQR Capital Management

Aquatic Capital

Aspect Capital

Athena Capital Research

Balyasny Asset Management

BFAM Partners

Bluecrest Capital

Bluefin Trading

Boerboel Trading

Cantab Capital Partners

Capital Fund Management

Capula Investment Management

Chicago Trading Company

Citadel Asset Management

Citadel Securities

Crabel Capital

Cubist Systematic Strategies

DE Shaw

DRW

Engineers Gate

Epoch Capital

Final

Flow Traders

Gelber Group

Geneva Trading

Graham Capital

G-Research

GSA Capital

GTS

HC Technologies

Hudson River Trading

IMC

Informed Portfolio Management

Istra Research

Jane Street

Jump Trading

Liquid Capital

Man Investments

Marshall Wace

Maven Securities

Millennium Management

Old Mission Capital

Optiver

PDT Partners

Peak6

Point72 Asset Management

Quadrature

Quantbot Technologies

Quantlab

Qube Research & Technologies

Radix Trading

Renaissance Technologies

Squarepoint Capital

Susquehanna International Group

Systematica Investments

Teza Technologies

Tibra Trading

Tower Research Capital

TransMarket Group

Transtrend

Tudor Capital

Two Sigma

Vatic Labs

Virtu Financial

Vivienne Court

Volant Trading

Voleon

Winton Capital

Worldquant

XR Trading

XTX Markets