We’ve analysed the career sites of 52 of the most prominent hedge funds and proprietary trading firms that employ quantitative investment strategies. This report does not seek to draw any conclusions about the health of the hiring landscape, or the impact of Covid-19, however, it does break down the number of open roles/jobs posted by location, job division and the changes in Q3 (July, August, September 2020).

>Stay on top of the Hedge Fund job market with GL for jobs

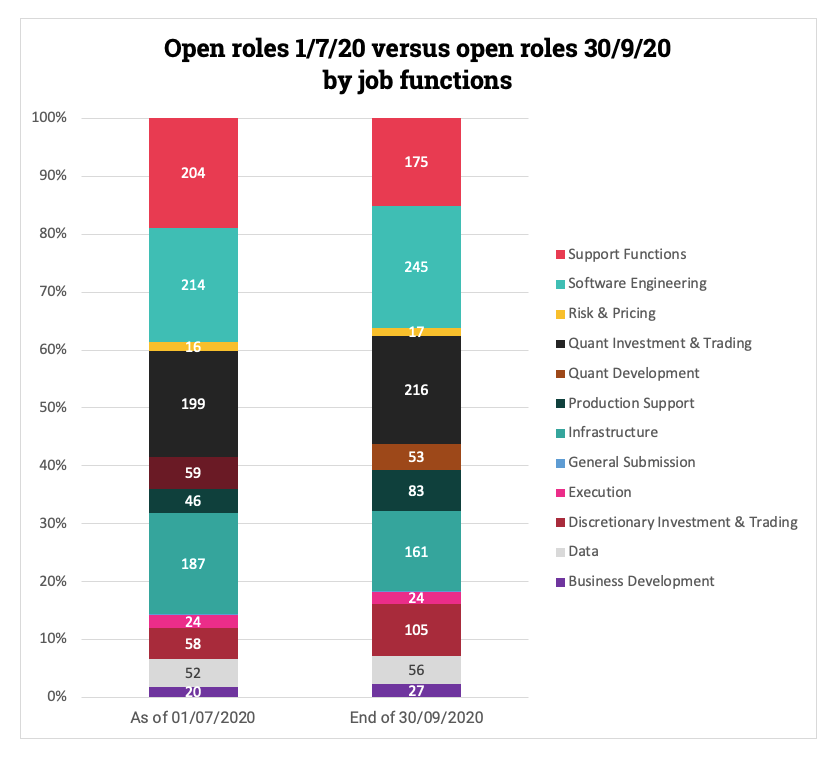

Open roles at the beginning and end of Q3

The total number of open roles at the beginning of July was 1082 compared to 1163 open roles at the end of September. The bar below shows a breakdown of open roles in each job function at the start and end of Q3 (not counting 'general submissions').

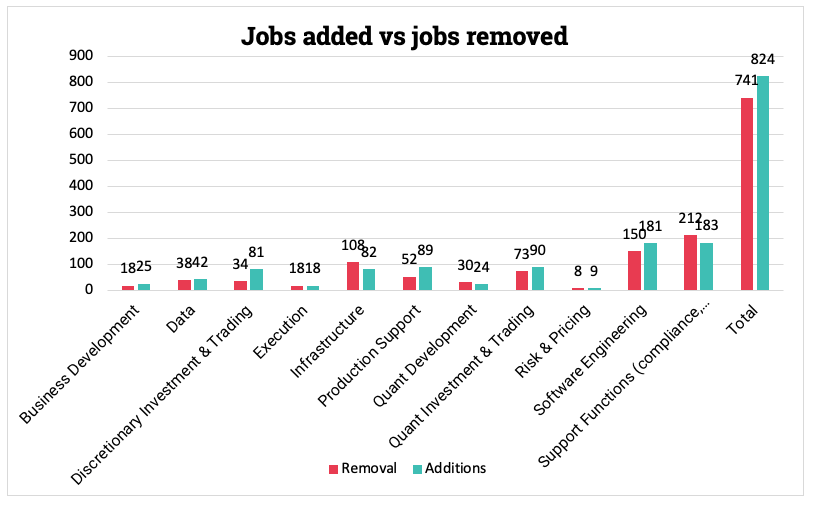

Jobs added versus removed

The below chart gives a breakdown of the number of jobs added vs the number of jobs removed per job function in July to September.

The most striking feature is in ‘Discretionary Trading and Investment’ where only 34 jobs have been removed compared to 81 jobs added. The only three job functions where more have been removed than added are: ‘Infrastructure’, Quant Development’ and ‘Support Functions’ (compliance, operations, finance, HR, Admin). The job function with the least difference between jobs added and removed is ‘Execution’.

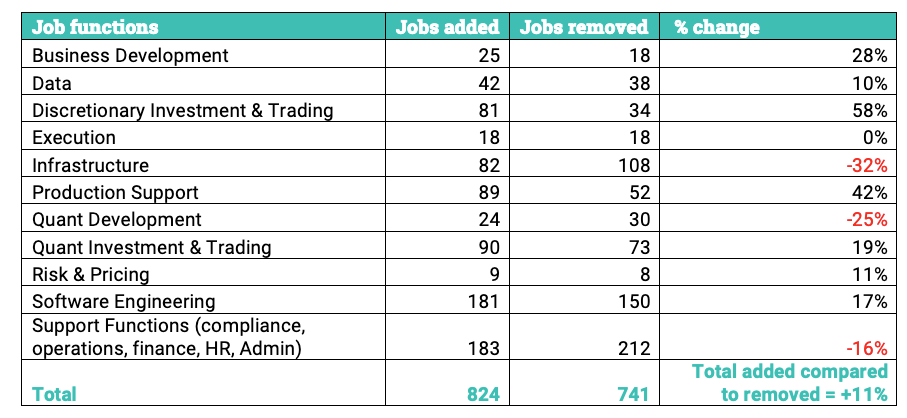

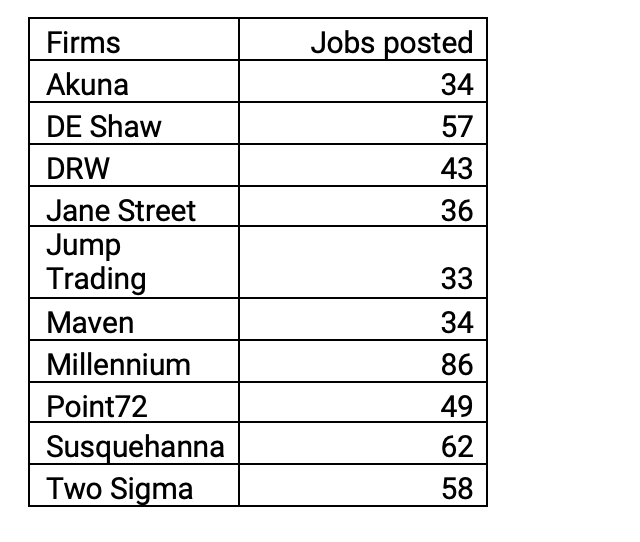

Top 10 hiring firms

The top 10 most active firms in Q3 by number of job postings are:

Who’s hiring

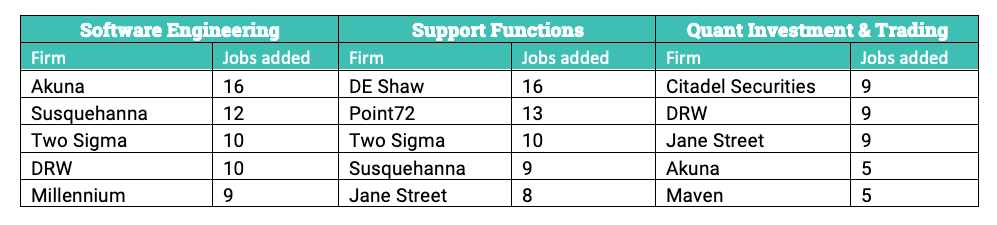

The most active hiring is taking place across Software Engineering, Quant Investment & Trading and Support Functions (compliance, operations, finance, HR, Admin). The table below show the top 5 firms by job positing in these job functions.

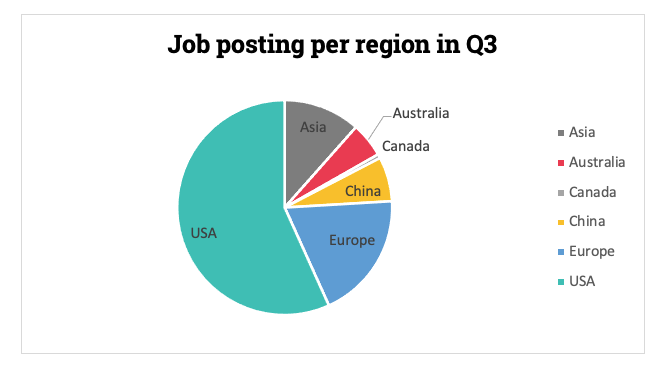

Where are firms hiring?

The pie chart below shows where most jobs have been posted in Q3.

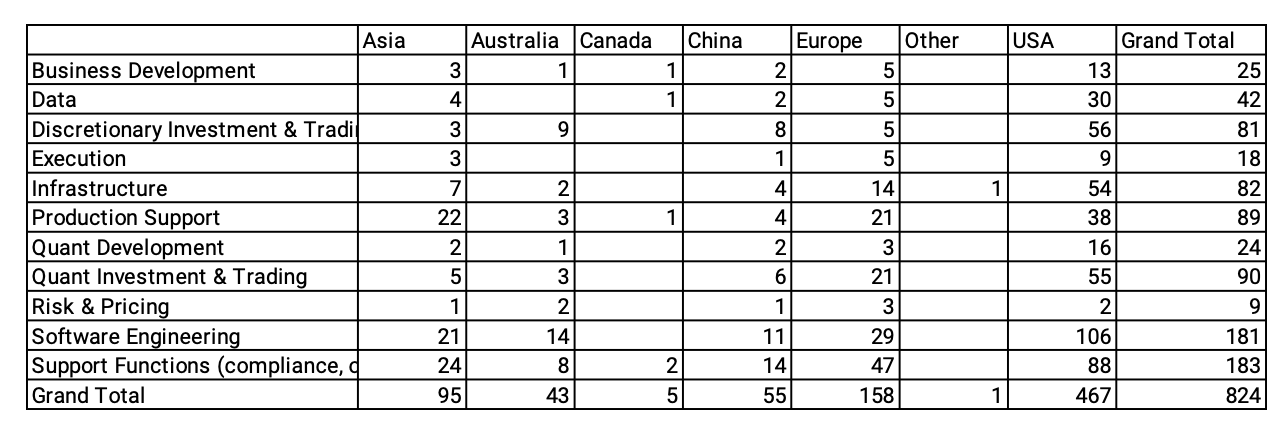

The location where most firms are hiring is, needless to say, the US. For ‘Production Support’, Asia and Europe is also a particular hot spot and the same goes for ‘Support Functions’. As the only exception, Risk & Pricing is more needed in Australia and Europe than the US.

The table below the pie chart shows a breakdown of job functions.

>Stay on top of the Hedge Fund job market with GL for jobs

Notes for the report

The figures were captured from the career sites of the below firms between 1 July – 30th September 2020.

It’s worth noting that not every firm posts all of their open roles on their career sites so the actual activity and/or number of live roles may be different. This report only seeks to analyse the publicly available information.

We will also caveat that just because a role was removed does not necessarily mean that it has been filled although it’s reasonable to assume that if somebody has taken the time to upload or remove a role there is a reason behind it.

Firms analysed

|

1. 3Red 2. Acadian 3. Akuna 4. Allston 5. AQR 6. Aspect 7. Balyasny 8. BlueCrest 9. Cantab 10. Capital Fund Management 11. Capula 12. Chicago Trading Company 13. Citadel Investments 14. Citadel Securities 15. Cubist 16. DE Shaw 17. DRW 18. Engineers Gate 19. Epoch Capital 20. Flow Traders 21. Gelber 22. Graham Capital 23. GSA Capital 24. GTS 25. HRT 26. IMC 27. IPM 28. Jane Street 29. Jump Trading 30. Liquid Capital 31. Marshall Wace 32. Maven 33. Millennium 34. Optiver 35. PDT Partners 36. Peak6 37. Point72 38. Quantbot 39. Quantlab 40. Qube 41. Radix Trading 42. Schonfeld 43. Squarepoint 44. Susquehanna 45. Tibra 46. Tower Research 47. Two Sigma 48. Virtu 49. Volant 50. Winton 51. XR 52. XTX Markets |