This report analyses the salaries of Quantitative analysts/researchers in the quant trading industry from 2019 to date from a universe of the top 70 quant hedge funds and proprietary trading firms.

We would like to caveat that following the Jan 2020 introduction of Labor Law Section 194 in New York, and similar rules in other states, it became illegal to ask for current or historical salary data. This analysis has been compiled using salary data captured from H1B visa filings. We believe H1B salaries do not deviate too much from the local standard, and so make for a great point of reference.

We also need to caveat we were unable to break the data down by level or experience which does skew the figures. However, base salaries do tend to cap out in the quant trading industry around the $250-300k mark with the bulk of compensation being paid in bonus.

General Overview:

In general the salary outlook for Quant Analysts is very positive:

We have a sample of 637 datapoints collected between 2019 and mid-2021, which suggests demand is still strong even with all the chaos of the past year.

Excluding bonuses or commission, we have a minimum salary of $48,901 and a maximum of $300,000, with a median of $150,000 and an average of $153,019.

Within the Industry:

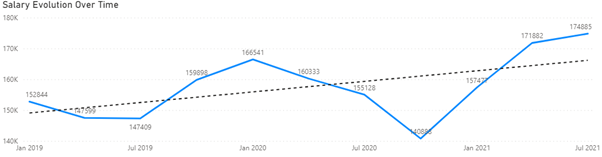

If we look at the salary evolution over time and across companies, it is looking very healthy indeed, especially compared to other jobs we analysed.

The overall trend line has been steadily going up from January 2019, by approx. $15,000.

In terms of quarter to quarter evolution, we can see average salaries rising around January of every year, and they also tend to decline in or around Q3 of every year.

We suspect this is because Q3 is in line with the end of the school year (and the hiring of a lot more junior employees).

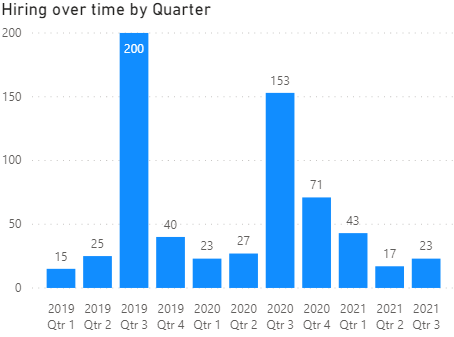

The hiring over time chart seems to support this hypothesis, with 59% of our datapoints being Q3 hirings, and Q1 having some of the lowest volumes.

Top Employers:

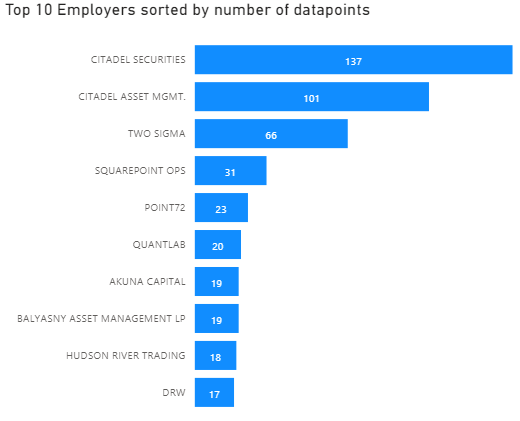

The top 3 Quant Analyst employers are Citadel Securities, Citadel Asset Management and Two Sigma. But together, the two Citadels make up 37.3% of hirings (21.5% for Citadel Securities and 15.85% for Citadel Asset Management).

Two Sigma takes third place with 54 job openings, or 10.3%. The rest of the companies on the list each account for 5% or lower, and the list is as follows:

Job titles:

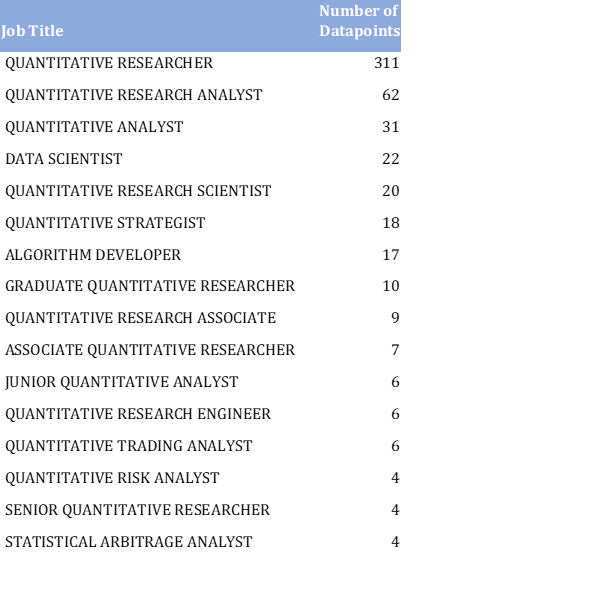

Different firms have different titles for their quants so below is a quick analysis of the job titles we included in this report. From our sample we counted the job titles and “Quantitative Researcher” was the prevalent job title. We ranked job titles with more than 4 datapoints, and Quant Researchers make up 57.9% of that list. This is the full ranking:

The geography:

We compiled a list of the highest paying American cities for Quant Analysts. To keep things relatively balanced, we have only included those where we had more than 5 datapoints to draw from.

Chicago takes first place, and together with New York City they dominate in terms of compensation, but also in hiring volume: NYC accounts for 47.8% of hiring (305 datapoints) and Chicago is 36.7% (234 datapoints).

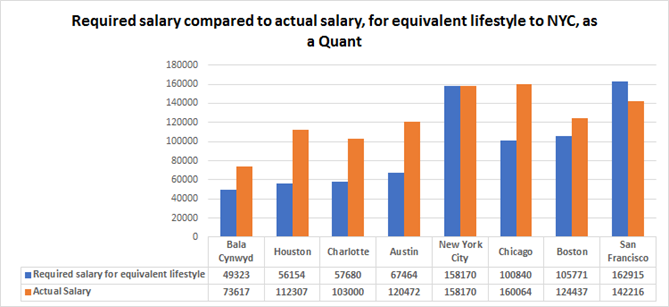

Using New York City as a baseline (because it has the largest hiring volume) we compared the cost of living to the rest of the cities to find out how much more (or less) money one would need in order to live the same lifestyle.

What we got is a comparison of the Quant Analyst salary per city (in orange) and the required amount of money for equal purchasing power as the New York City salary.

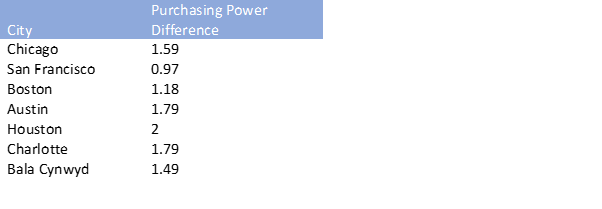

This is the “quant purchasing power index” that we arrived at:

In conclusion, if you want to make every dollar go as far as possible, the optimal earning power/cost of living ratio seems to be in the cities of Houston and Austin, and also in Charlotte, North Carolina.

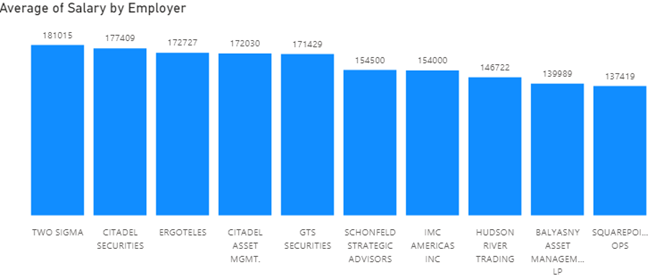

Okay – but who pays the most?

As a general rule, we tend to only factor companies in comparisons when we have 5 datapoints or more to draw from, in order to form some sort of conclusion.

Also, we would like to once again caveat that this analysis is only built upon publicly available H1B visa filing information, and may not reflect the entire reality. It also, does not factor in bonuses and commission.

That said, we have Two Sigma at the top with $181,015 average pay, followed by Citadel Securities($177,409) and Ergoteles ($172,727). We also have Citadel Asset Management and GTS Securities, at $172,030 and $171,429 respectively.

Competition is pretty tight, as the top company only pays about 5.3% more than number 5.

Summary:

The high demand for practical STEM related skills across every industry is translating into higher wages for quants. Absolutely no surprises here then. What was interesting in this report is the cost of living analysis. There seems to have been a shift in opinion, at least from management, about staff coming back to the office. Will employees be able to continue to earn their NYC salary whilst working remotely in a low-cost location?

To get a copy of the full salary report that provides detailed analysis of the top 10 funds please click here