Preparing a pitch deck is a process that most aspiring and accomplished portfolio managers will have to go through at some point in their career. Having seen the good and bad we thought it would be useful to prepare a checklist of what you should include.

Please note, this guide is based on preparing a pitch deck as part of a recruitment process. A pitch deck for capital raising requires professional advice on disclaimers and fund structure etc.

A good pitch deck provides context, clarity and rationale for your approach to investments. This is exactly what an interviewer will look for so prepare in advance of any interviews. Please note, you should only share the deck if requested and never share before a first round interview. Finally, a pitch deck is a marketing document - it is not a business plan - so does not need to include the minutiae of implementation.

The basic contents of the deck should include:

- Summary / investment objective

- Biographies

- Strategy description

- Track record

- Infrastructure requirements

Summary & investment objective

This is your elevator pitch and should answer the fundamental question… why? Don’t just answer the obvious, why should I invest, but really think about why you get up every morning and what differentiates you from everybody else. If you can’t answer that questions, don’t expect an interviewer to do it for you.

Biography(ies)

Your bio (or Bio’s if a team) should provide just enough detail to give credibility to the document and should include education, relevant work experience and history. It is not a resume so should only be one of two paragraphs per person.

Strategy Description

This slide should include a description of your strategies; style, investment universe, markets and instruments traded and holding periods. You should also include your risk management process from sizing, positioning and drawdown limits.

Track Record

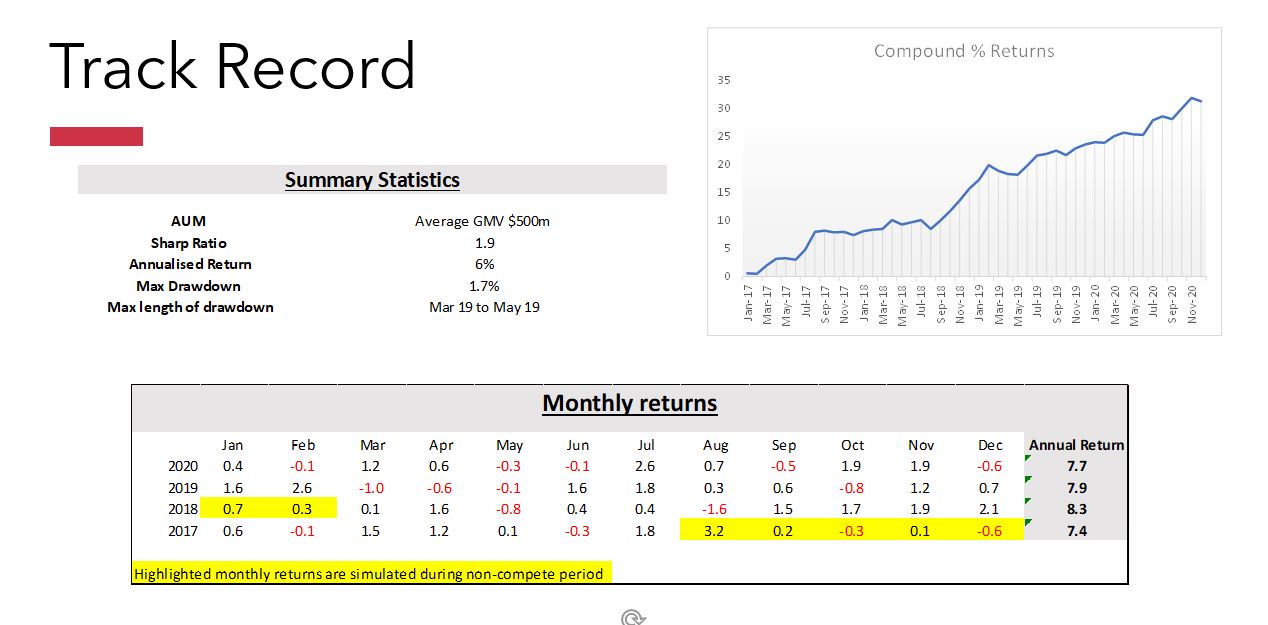

Unless you run a book in an independent vehicle you do not own your track record. However, despite the obvious caveats, prior performance is a good indication of future returns and will at least show how your strategy has performed historically during different market regimes and/or events. You can include a chart showing cumulative daily or monthly returns (based on strategy) and a table highlighting key performance metrics like annualized return, sharp ratio, peak to trough drawdown etc.

If you are going to share your track record, it’s important to include book size and highlight live performance versus back test. It’s ok to have gaps in your live track record that are based on a back test, say for example when you are in between roles. Realistically you should have at least two years of live track record to be considered for a PM seat.

Infrastructure requirements

You can include any strategy specific requirements like tick level data, any alternative data sets or even latency requirements. As some of this information may be commercially sensitive this slide may just be for your own reference and can be used when evaluating your potential new employer.

As mentioned, a pitch deck is the building block of a business plan so can be used when considering outside opportunities but also when looking to grow within your current firm.