We analysed the career sites of 52 of the most prominent hedge funds and proprietary trading firms that employ quantitative investment strategies. This report does not seek to draw any conclusions about the health of the hiring landscape, or the impact of Covid 19, however, it does break down the number of open roles by location, job division and the changes from between May and July.

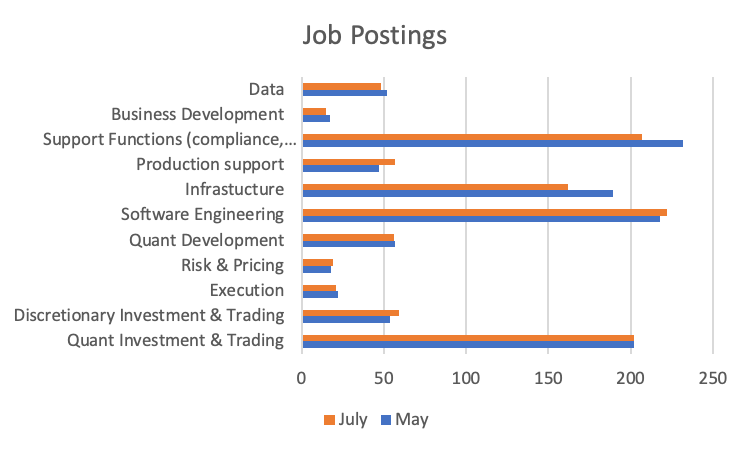

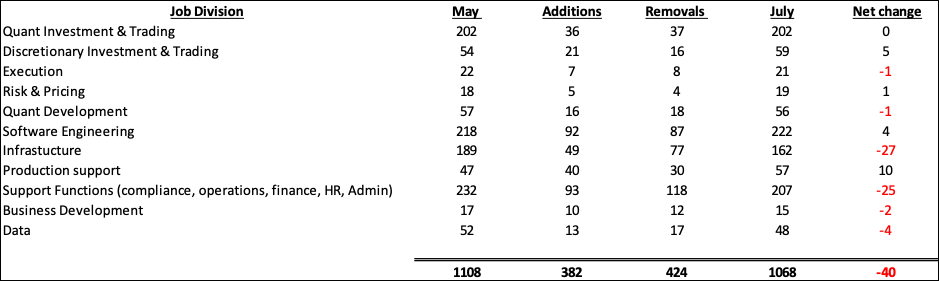

The total number of open roles at the beginning of May was 1,108. Just over two months later the number of open roles had dropped very slightly to 1,068. Based on these numbers it does not look like much activity has taken place, however, this is not an accurate picture of the hiring reality as over 382 new jobs were added and 424 were removed.

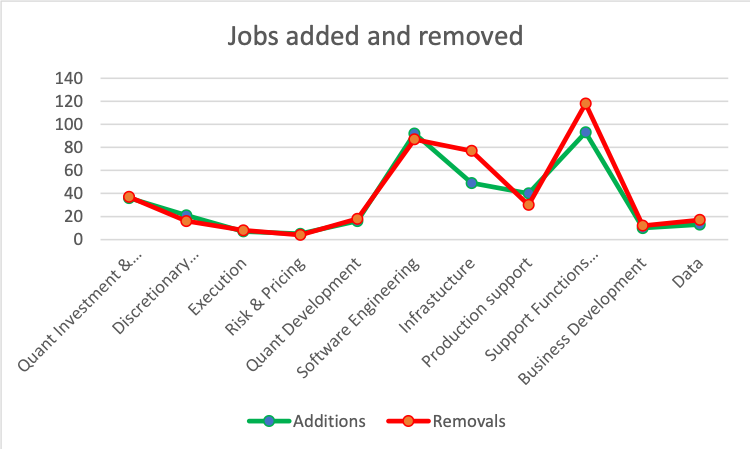

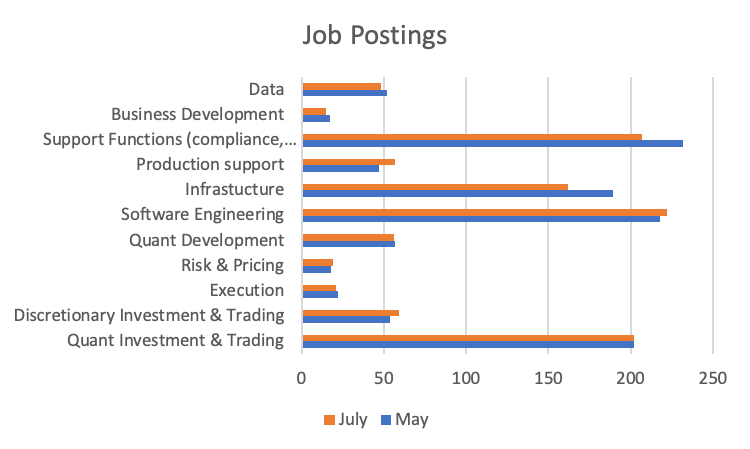

The above chart gives a breakdown of the jobs added and removed during the period. The most striking feature is the lack of Investment and Trading jobs posted or removed. But there is a logical answer to this. Many firms keep generic job postings up for roles such as Quant Researcher and/or Portfolio Manager. The basic requirements for these roles are the same i.e. developing and implementing systematic strategies and the ability to code, albeit with different flavours. Outside of those core requirements, the difference in posting is generally based on asset class or frequency traded. Hence, why some large firms post several different generic quant research/PM positions for each market they trade.

The most activity took place in the Support division with 93 additions and 118 removals. This is unsurprising as we have combined several different functions into Support (Compliance, Operations, Finance, HR and Admin). We concluded that hiring within this division is less speculative and more based on an actual headcount hence. Generic job posting will not capture the specific skills required within this division.

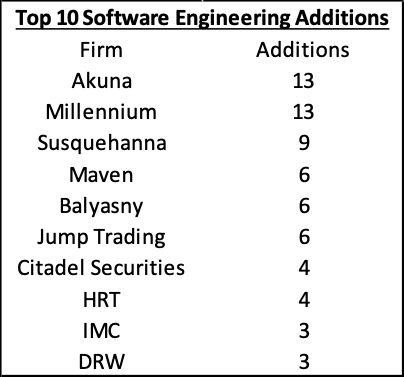

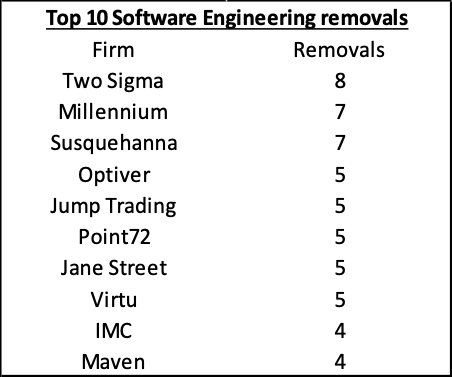

Software Engineering

Unsurprisingly, Software Engineering is very active and is the largest job division according to the number of job postings. Although there are generic Software Engineer job postings included in the total numbers, Software Engineering does generally involve quite specific skills which require more specific job postings.

The top 10 by number of Software Engineering job postings include eight firms that employ high frequency strategies (Millennium and Squarepoint do trade intraday but wouldn’t necessarily be called Market Makers).

The top 10 based on activity however looks a bit different.

Akuna has added 13 new Software Engineering roles, mostly in Chicago and are jointly top with Millennium. Activity across the other firms additions and removals indicates healthy activity so despite the lockdown, due to Covid-19, hiring did manage to take place.

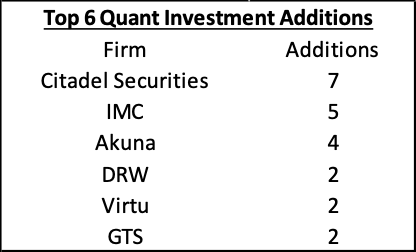

Investment and Trading

We have broken down investment and trading into Quant and Discretionary. The Discretionary job postings were picked up in our analysis as we included large multi-managers like Millennium, Citadel, Point72 etc. that have significant quant operations.

The number of open roles was the same between May and July at 202, however, as already caveated, a lot of the job postings for investment and trading positions are static reflecting the ongoing demand for talent in these divisions. These figure may just represent the number of different variations of the generic role they have uploaded rather than actual live positions.

.png)

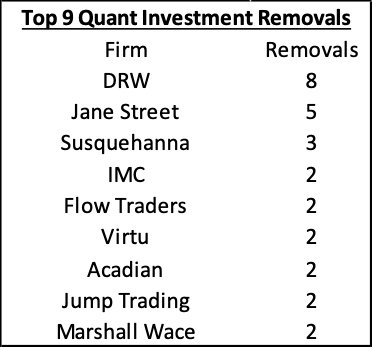

The activity again does paint a different picture.

The activity of adding and removing roles in quant investment and trading was a lot more subdued. Outside of the top 6 there were 14 firms that posted one new position with the remaining 32 not adding any new quant investment positions. This is clearly not an indication of actual activity, however, does reinforce our assumption that job posting remains static for this job division.

Overall Picture

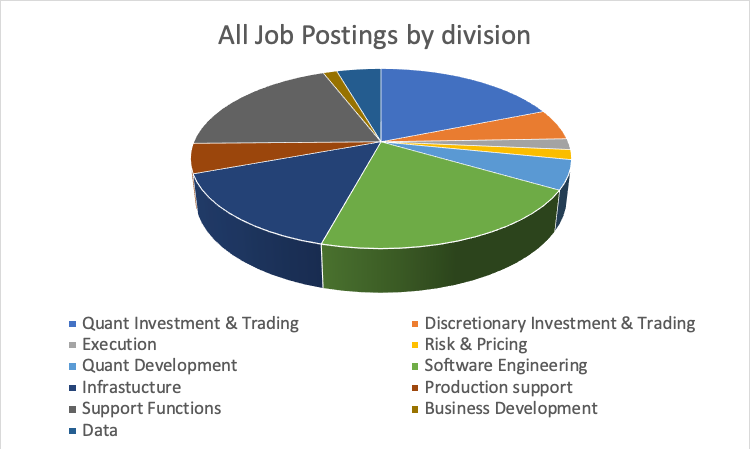

As of 9th July, the largest posting by job division were Software Engineering, Support Functions, Quant Investment & Trading and Infrastructure which should be expected based on the sample firms.

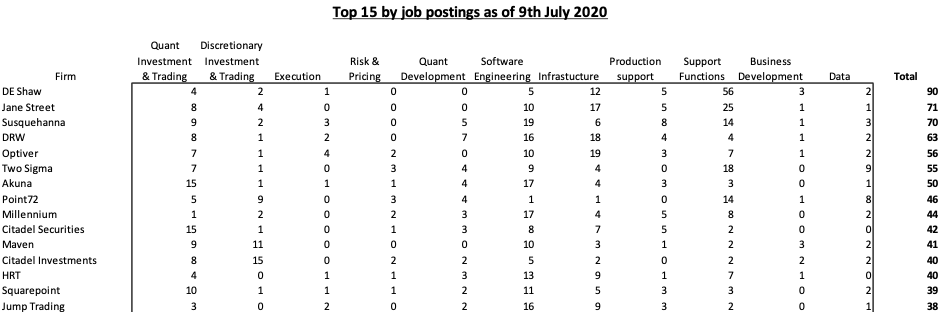

The top 15 overall by job postings were dominated by the more established larger firms, however, Akuna and Maven appear to be growing rapidly.

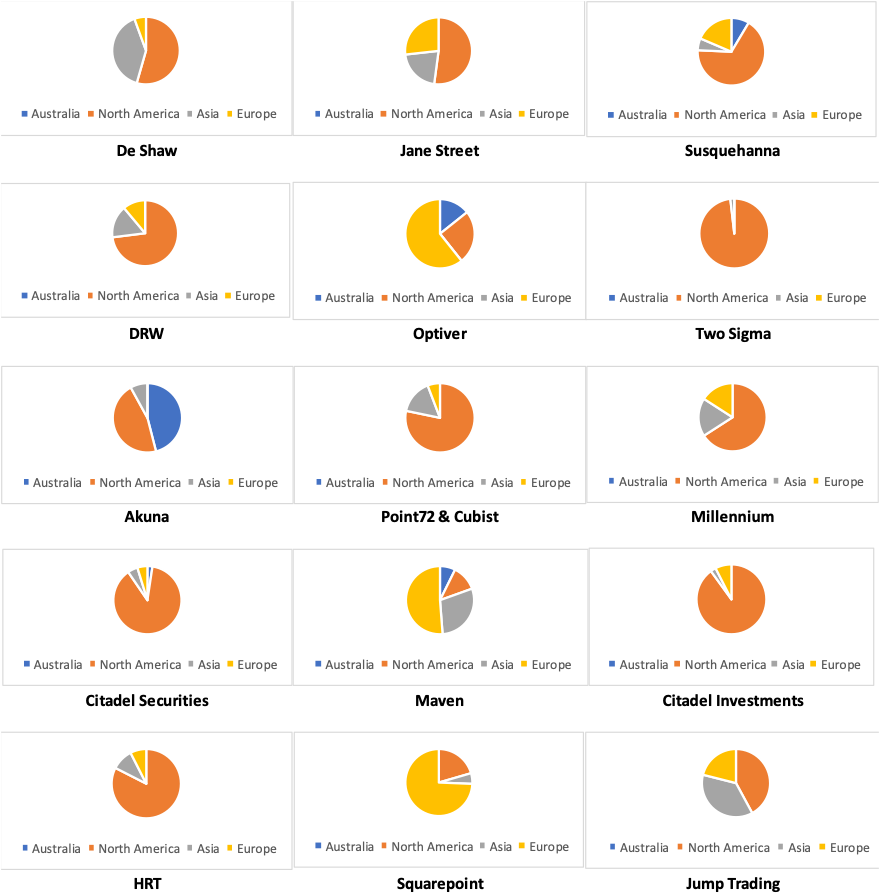

The regions where the top 15 are hiring in paints a picture of their growth strategy. The headquarters for each firms remains the largest by job posting.

Overall, the job market appears healthy across quantitative investment. This is probably a reflection of the bounce back in market in April and the PNL to be made with the increase in volumes traded and volatility. We do not think the full effects of remote working have fed into activity however the changing face of what “the office” looks like may start to impact on activity moving into Q3 and Q4.

If you would like to see the full report along with the opportunity to join GL for Jobs and Optimise Me, please register by clicking here.

Notes for the report

The figures were captured from the career sites of the below firms between 1 May and 9th July.

It is worth noting that not every firm posts all of their open roles on their career sites so the actual activity and/or number of live roles may be different. This report only seeks to analyse the publicly available information.

We will also caveat that just because a role was removed does not necessarily mean that it has been filled although it’s reasonable to assume that if somebody has taken the time to upload or remove a role there is a reason behind it.

Firms analysed

3Red, Acadian, Akuna, Allston, AQR, Aspect, Balyasny, BlueCrest, Cantab, Capital Fund Management, Capula, Chicago Trading Company, Citadel Investments, Citadel Securities, Cubist, DE Shaw, DRW, Engineers Gate, Epoch Capital, Flow Traders, Gelber, Graham Capital, GSA Capital, GTS, HRT, IMC, IPM, Jane Street, Jump Trading, Liquid Capital, Marshall Wace, Maven, Millennium, Optiver, PDT Partners, Peak6, Point72, Quantbot, Quantlab, Qube, Radix Trading, Schonfeld, Squarepoint, Susquehanna, Tibra, Tower Research, Two Sigma, Virtu, Volant, Winton, XR, XTX Markets.

If you would like to see the full report along with the opportunity to join GL for Jobs and Optimise Me, please register here.