This is the quarterly Grainstone Lee report analysing firms that employ quantitative investment strategies. The report contains an in-depth analysis of the hiring and competitive landscape within key geographical regions.

The quarterly report contains thousands of sourced data points across the largest financial job functions from Quantitative Investment & Trading to Business Development and Compliance.

Skip to:

Open roles at the beginning and end of Q3

The most in demand job functions

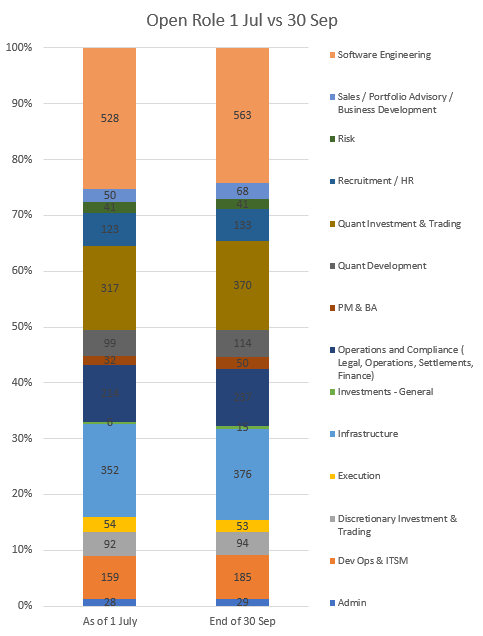

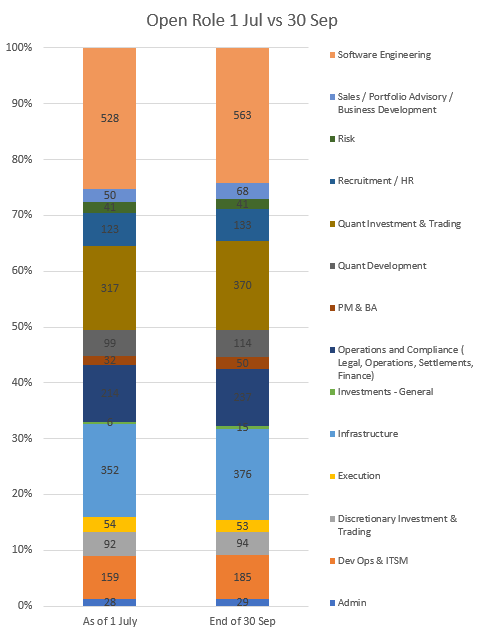

Open roles at the beginning and end of Q3

The total number of open roles at the beginning of July 2021 was 2,095 compared to 2,328 open roles at the end of September. The bar below shows a breakdown of open roles in each job function at the start and end of Q3.

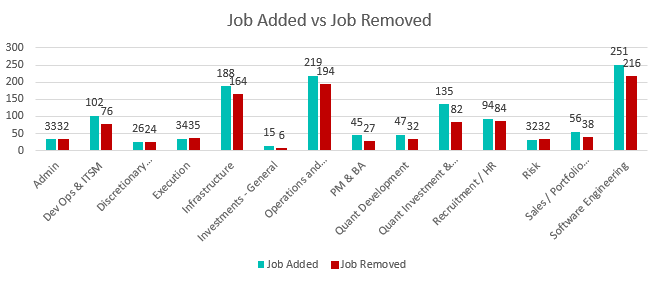

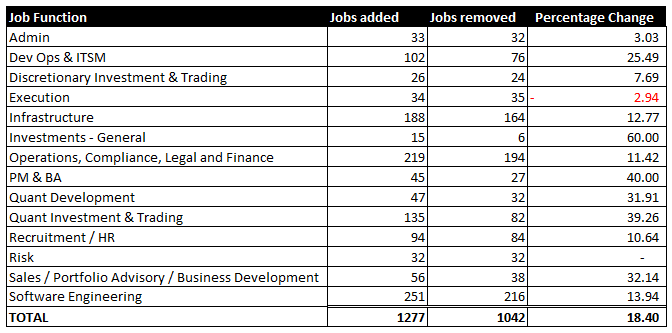

Jobs added versus removed

The below chart gives a breakdown of the number of jobs added vs the number of jobs removed per job function from July to September 2021.

Overall there is an 18.4% increase in jobs added versus removed. Across the board there has been increases with the exception of execution and risk.

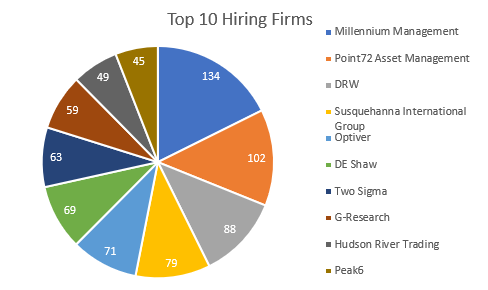

Top 10 hiring firms

The top 10 most active firms by number of job postings are:

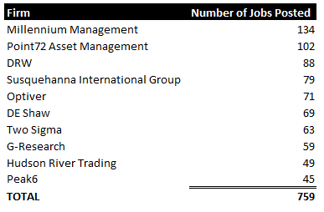

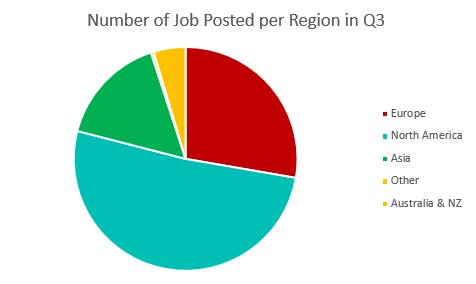

The most in demand job functions

The most active hiring is taking place across Software Engineering, Support (Operations Compliance, Legal & Finance), Infrastructure and Quant Investments & Trading – similar to the last quarter

The table below shows the top firms by number of jobs posted.

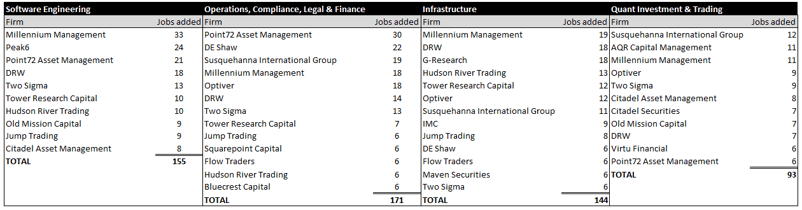

Where are firms hiring?

The pie chart below shows where most jobs have been posted in Q3.

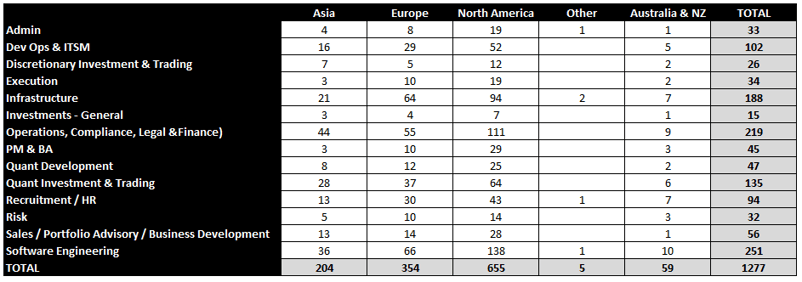

The table below shows a breakdown of job functions by region.

The location where most firms are hiring is, needless to say, the US.

Software Engineering shows strong demand across all regions as well as Infrastructure and Dev ops roles.

Notes for the report

The figures were captured from the career sites of the below firms between 1st July – 30th September 2021.

It’s worth noting that not every firm posts all of their open roles on their career sites so the actual activity and/or number of live roles may be different. This report only seeks to analyse the publicly available information.

We will also caveat that just because a role was removed does not necessarily mean that it has been filled although it’s reasonable to assume that if somebody has taken the time to upload or remove a role there is a reason behind it.

Firms analysed

3Red Partners

ABC Arbitrage

Acadian Asset Management

Akuna Capital

Allston Trading

AQR Capital Management

Aquatic Capital

Aspect Capital

BFAM Partners

Bluecrest Capital

Chicago Trading Company

Citadel Asset Management

Citadel Securities

Crabel Capital

Cubist Systematic Strategies

DE Shaw

DRW

Engineers Gate

Epoch Capital

Final

Flow Traders

Geneva Trading

G-Research

GTS

HC Technologies

Hudson River Trading

IMC

Jump Trading

Liquid Capital

Marshall Wace

Maven Securities

Millennium Management

Old Mission Capital

Optiver

PDT Partners

Peak6

Point72 Asset Management

Quantbot Technologies

Quantlab

Qube Research & Technologies

Radix Trading

Renaissance Technologies

Squarepoint Capital

Susquehanna International Group

Tibra Trading

Tower Research Capital

TransMarket Group

Transtrend

Tudor Capital

Two Sigma

Vatic Labs

Virtu Financial

Vivienne Court

Volant Trading

Voleon

Winton Capital

Worldquant

XR Trading

XTX Markets