This is the quarterly Grainstone Lee report analysing firms that employ quantitative investment strategies. The report contains an in-depth analysis of the hiring and competitive landscape within key geographical regions, however, it does not seek to draw any conclusions about the health of the hiring landscape, or the impact of Covid-19.

Each quarterly report contains thousands of sourced data points across the largest financial job functions from Quantitative Investment & Trading to common roles such as Business Development and Compliance.

Skip to:

Open roles at the beginning and end of Q1

The most in demand job functions

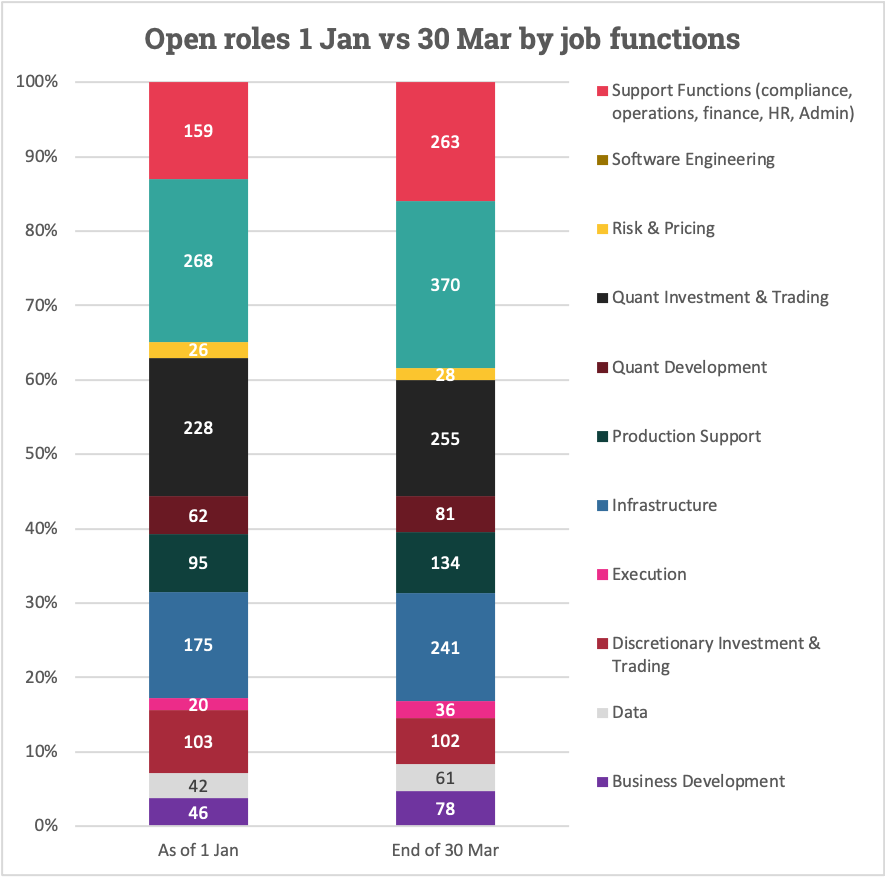

Open roles at the beginning and end of Q1

The total number of open roles at the beginning of January was 1,224 compared to 1,649 open roles at the end of March. The bar below shows a breakdown of open roles in each job function at the start and end of Q1.

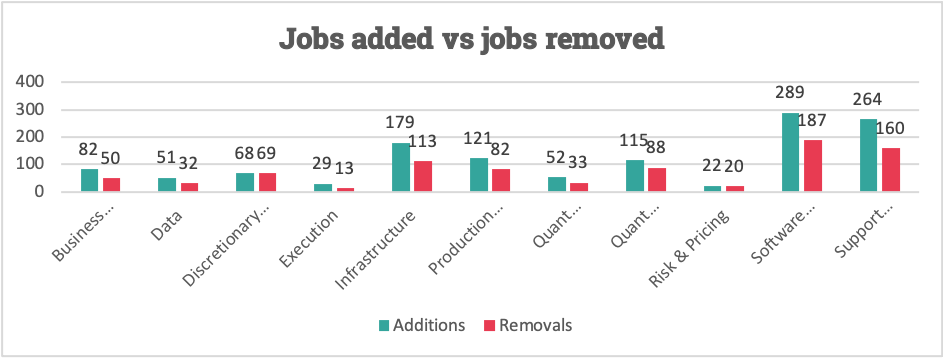

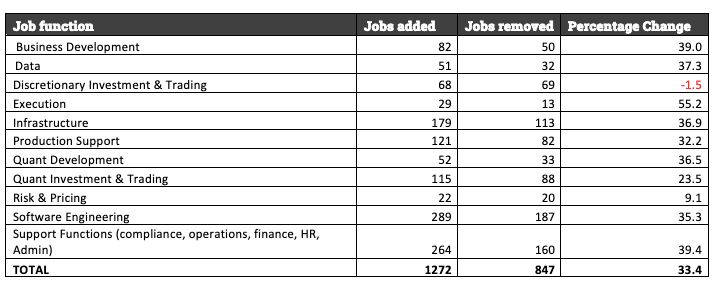

Jobs added versus removed

The below chart gives a breakdown of the number of jobs added vs the number of jobs removed per job function in January to March 2021.

There is a 33.4% increase in jobs added versus removed. This is three time as high as the increase of jobs added versus removed in Q4 2020.

There has been 612 more jobs added in Q1 2021 than in Q4 2020, however, there were 257 more jobs removed in Q1 than Q4.

The only division that has more jobs removed than added is Discretionary Investment & Trading. There has been a significant growth in all other areas with Execution in the lead.

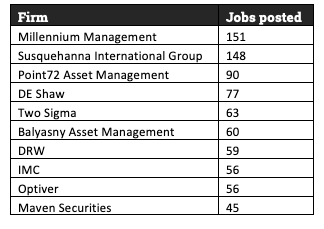

Top 10 hiring firms

The top 10 most active firms by number of job postings are:

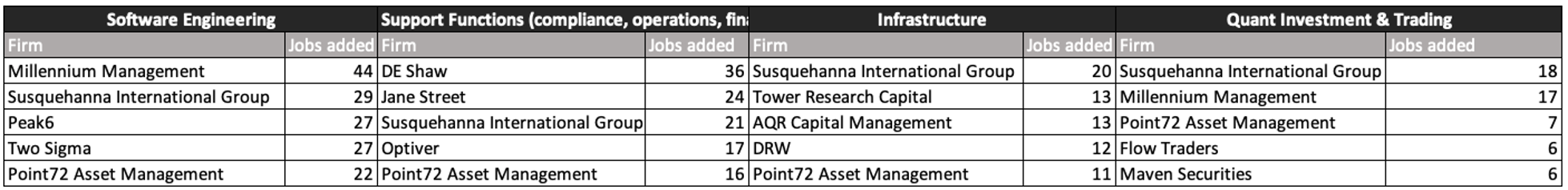

The most in demand job functions

The most active hiring is taking place across Software Engineering, Support (Compliance, Operations, Finance, HR, Admin) and Infrastructure – similar to the last quarter. We’ve also included ‘Quant Investment & Trading’ in this table even though it’s only the fifth most active job function out of the 11 included in our analysis.

The table below shows the top five firms by jobs posted in these job functions.

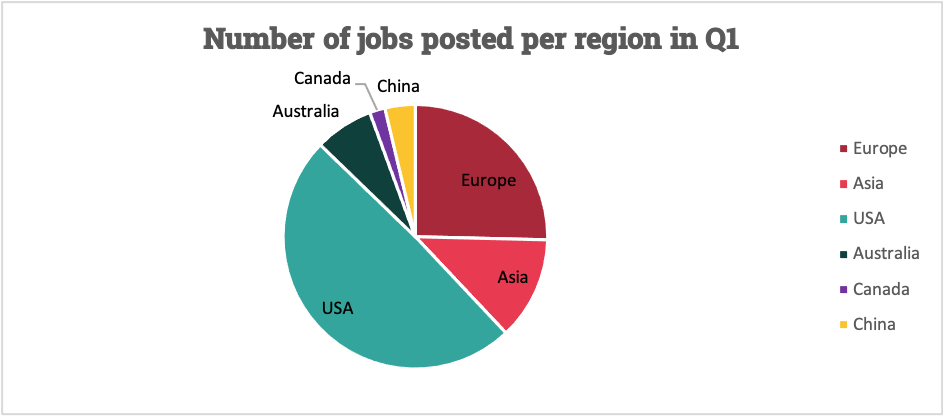

Where are firms hiring?

The pie chart below shows where most jobs have been posted in Q1.

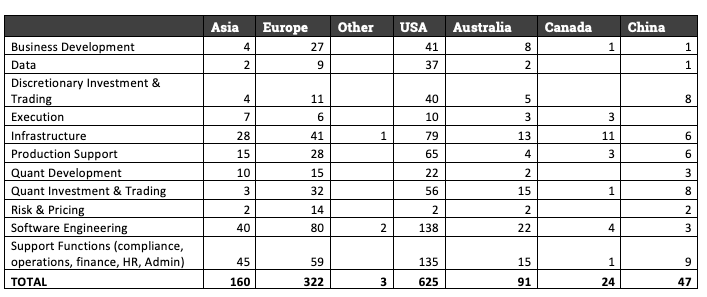

The table below shows a breakdown of job functions by region.

The location where most firms are hiring is, needless to say, the US.

Risk & Pricing is consistently low in all regions and so is Execution a part from in the US.

Software Engineering is, as usual, a hot spot across all regions. Quant Investment & Trading is significantly low in China compared to in the US and the same goes for Discretionary Investment & Trading.

Notes for the report

The figures were captured from the career sites of the below firms between 1st January – 30th March 2021.

It’s worth noting that not every firm posts all of their open roles on their career sites so the actual activity and/or number of live roles may be different. This report only seeks to analyse the publicly available information.

We will also caveat that just because a role was removed does not necessarily mean that it has been filled although it’s reasonable to assume that if somebody has taken the time to upload or remove a role there is a reason behind it.

Firms analysed

- 3Red

- Acadian

- Akuna

- Allston

- AQR

- Aspect

- Balyasny

- BlueCrest

- Cantab

- Capital Fund Management

- Capula

- Chicago Trading Company

- Citadel Investments

- Citadel Securities

- Cubist

- DE Shaw

- DRW

- Engineers Gate

- Epoch Capital

- Flow Traders

- Gelber

- Graham Capital

- GSA Capital

- GTS

- HRT

- IMC

- IPM

- Jane Street

- Jump Trading

- Liquid Capital

- Marshall Wace

- Maven

- Millennium

- Optiver

- PDT Partners

- Peak6

- Point72

- Quantbot

- Quantlab

- Qube

- Radix Trading

- Schonfeld

- Squarepoint

- Susquehanna

- Tibra

- Tower Research

- Two Sigma

- Virtu

- Volant

- Winton

- XR

- XTX Markets